Your Investor Day will undoubtedly be one of the most important milestones for your company this year. Countless hours, resources, and proverbial blood, sweat, and tears will go into the planning of this multi-faceted event. Being everything from event planner, technical manager and project manager to content creator, spokesperson trainer, and professional cat herder to get your executives engaged from kick off to show time is no easy task – not to forget your day job as an IRO.

We have helped hundreds of public companies successfully execute investor days. The secret sauce: a well-coordinated team effort united by a clear objective, strategic planning, and an expert to anticipate and plan for what might go wrong, so it doesn’t. Here are five common Investor Day mistakes and tips on how to avoid them.

1. The “Jump-the-Gun”

1. The “Jump-the-Gun”

The situation: The decision to organize an investor day was made, the date was selected, and you start developing a plan of attack. You quickly realize, there’s just not enough time to get everything done or (even worse) you don’t have new compelling information to share.

The solution: Take your time when planning an investor day and hit the ground running. It’s not unusual to begin planning an investor day six months in advance. To kick off your process, develop a detailed project plan to break down the investor day components, identify the support you need, and outline an ideal timeline. Consider several dates for your investor day, talk to prospective venues about their availability, and check if analysts or large investors have conflicts, such as major trade shows or peer investor events. Lastly, but arguably most importantly, before you hit send on the save the date, make sure everyone is aligned on why you are doing an investor day. The answer may be to reveal a new strategic vision, outline long-term targets, or showcase your new leadership team. If the answer is “because our Board wants us to” or you simply aren’t ready to share compelling new information with the Street, you may be jumping the gun.

2. The “So What?” – Analyst headlines that flop

The situation: No matter how great the production is, if the content misses the mark, your analysts will throw you to the wolves. Nobody wants to see headlines like “Long on vision, short on specifics” or “Missing the Forest for the Trees” after spending all that time, energy, and money.

The solution: Listen to your audience and understand what is top-of-mind for investors and analysts before finalizing your core messages and picking your speakers. It can be helpful to conduct a full investor perception audit or even a quick pulse survey to solicit investor opinions and make sure you focus on the right topics. Remember the basics of presentation development: aim for 3-4 core messages to keep your presentation succinct, employ storytelling through the narrative and personal experiences, and provide meaningful new information and targets.

3. “Lights! Camera! No action…”

3. “Lights! Camera! No action…”

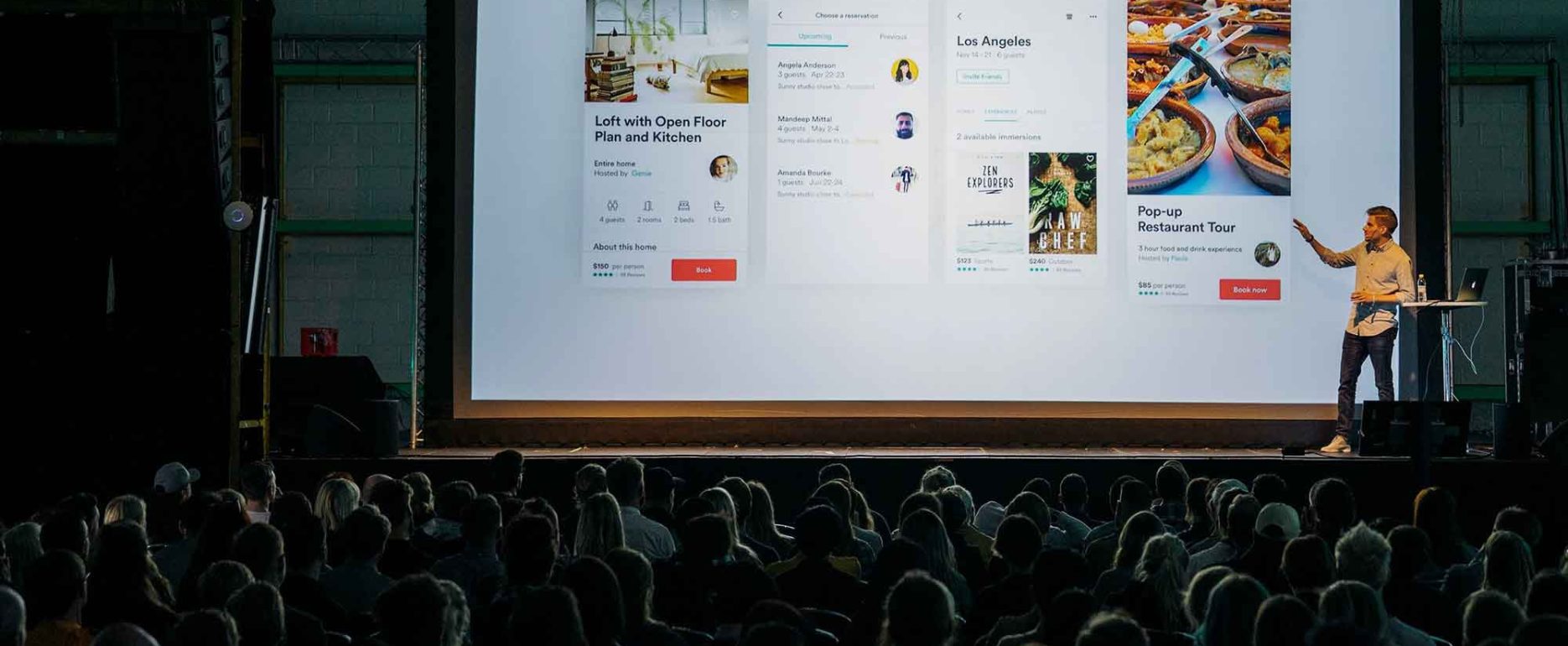

The situation: You’ve nailed the content for the investor day. Your speakers come on stage and start presenting. Quickly the audience has completely zoned out because the speakers’ delivery is disorganized, robotic and boring.

The solution: Prepare your speakers for the stage. Your CEO and CFO might be used to speaking in front of an audience and being questioned by analysts and investors – but the rest of your leadership team is not, so make time to practice. Schedule a dress rehearsal the day before (ideally in the fully staged event space). It is important for your speakers to get a feeling for the stage and the room. Taping the floor is good practice to prevent your speakers from walking out of the camera frame. Remind your presenters to speak loudly and clearly and use vocal variety. Adjusting the tone and cadence throughout the presentation makes the delivery more interesting and emphasizes key messages. Lastly, eye contact is critical. It draws people’s attention and keeps them engaged. In today’s hybrid world, this goes for your in-room audience and the virtual audience. If possible, leverage professional speaker training prior to the event to help your team nail the presentation delivery.

4. The “Wack-A-Mole”

4. The “Wack-A-Mole”

The situation: It’s nearly showtime. The presentation is finalized, your presenters are well prepared, the webcast and AV team is ready to go, and your attendees are trickling in. What could go wrong? In-room technology problems, webcasting issues, formatting trouble, missing name badges, last-minute slide fixes, not enough giveaways – the devil is in the details, and you can’t be everywhere all at once.

The solution: Assume everything can go wrong and plan for it. Create a ‘run of show’ that choreographs even the most minute of details and clearly identifies ownership. It’s helpful to have manpower on site to troubleshoot fires as they start to flame. You can avoid many last-minute surprises by planning a site visit with a person who knows the investor day process in and out and can ask the right questions. Are there wired Ethernet networks for laptops that are used by the speakers to present or communicate with the virtual audience? Who will be advancing slides and playing videos for the on-site and online audiences? Who will run mics during Q&A and field questions from the virtual audience? Once you have a clear understanding of what is needed, set up an AV and webcasting logistics call to get aligned. Lastly, pay attention to any font specifications your webcast player might have to ensure compatibility. Sending test materials to the webcast provider in advance can help spot issues before the big day.

5. “Oops, I shouldn’t have said that…”

The situation: The applause still rings in your ears as you guide the crowd out of the room. The official part of the investor day is over, and it seems a full success. Your leadership team is mingling with analysts and investors while enjoying lunch. Just as you begin to relax, you overhear one of your executives talk about that big contract you won but haven’t officially announced yet.

The solution: For many presenters, an investor day is their first interaction with the Street, so it’s best to offer a Reg FD refresher training for your executives. Explain what they can and can’t talk about, role-play potential offline discussions, give tips on how to handle tough questions and make sure everyone is clear on what to do should non-public material information be accidentally shared. That way, everyone is prepared to handle the heat.

Planning an investor day? Reach out to our Sharon Merrill team today to discuss how we can help make your investor day a great success.