A briefer for those new to developing ESG programs

We recently attended IR Magazine’s ESG Integration Forum, where a panelist confessed that she often felt overwhelmed by the seemingly endless onslaught of information and expectations around ESG. Her words were met with a roomful of commiserate nods.

And it’s no wonder. As the media’s topic du jour, ESG continues to be politicized, analyzed, and commented on by many with little to no experience in executing these programs. In addition, there are new regulations, countless rating agencies, and multiple stakeholders to consider – even the fear of being perceived as “greenwashing.” It’s a lot to process

As with many things in life, the enemy of getting started in ESG often is diving into the more complicated areas too soon. Instead, we typically advise clients to start with mastering the fundamentals. After this is accomplished, we can move to more advanced discussions on reporting, ratings, and the like.

In this article, we aim to provide a high-level briefer on the key concepts you should understand prior to moving forward with your ESG program. In subsequent ESG articles, we will break down and explain the most essential and relevant ESG topics for IR professionals and the C-Suite today.

Armed with this knowledge, you will be better equipped to advance your company’s ESG program and, as is our hope, to benefit from all the positive outcomes that entails.

1. What is ESG?

1. What is ESG?

In its truest sense, ESG is a disclosure practice and sustainable investment philosophy that centers on a firm’s performance against Environmental, Social, and Governance issues (hence “ESG”). The purpose of ESG investing is to utilize material risk factors across these categories, and beyond conventional financial data, to improve investment returns.

In many ways, ESG disclosure represents the natural evolution of corporate finance and accounting practices. For example, investors today utilize standardized financial metrics, such as revenues, expenses, and profitability, to gain an accurate view of a company’s performance over a given period. ESG investors simply want a wider set of disclosures, which, they believe, enables them to better assess risk and allocate capital.

Another way of framing this evolution is the movement away from a focus on shareholder value to a focus on stakeholder value, a concept popularized by Blackrock CEO, Larry Fink. In Fink’s words, this is “Stakeholder Capitalism,” where shareholders’ long-term returns are driven by a focus on mutually beneficial relationships between a company and its employees, customers, suppliers, and communities.

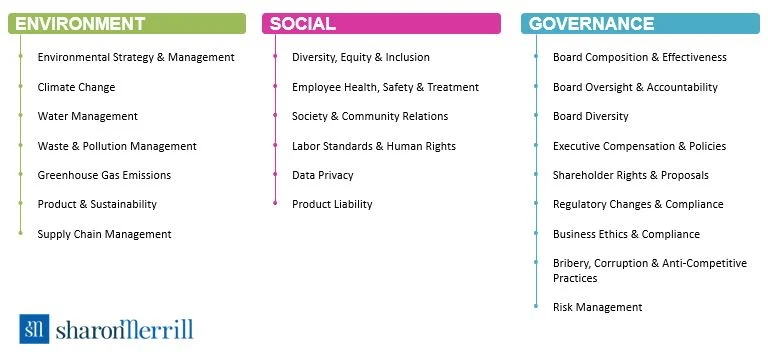

Consider the following table, which lists some of the different material issues that can fall under the three ESG categories.

2. What’s the business case for ESG?

Whether your team is measuring it or not, performance against ESG standards can have a tangible effect on your company’s ability to access capital, create value, manage risk, and safeguard your reputation.

Consider the following:

- Global ESG assets are expected to account for $50 trillion by 2025, or nearly a third of global AUM, versus $35 trillion in 2020, according to Bloomberg Intelligence.

- Global sustainable debt issuance hit a record of more than $1.4 trillion in 2021, more than double the 2020 pace, according to the Institute of International Finance.

- Positive environmental performance (the “E”) can drive stronger top-line growth, cost reduction, less regulatory intervention risk, higher employee productivity, and improved investment and asset optimization, according to McKinsey & Company.

- The overwhelming majorities of consumers and employees said they are more likely to buy from or work for companies that share their values across ESG, according to a 2021 PWC poll.

Clearly, companies can no longer wait to develop their ESG programs. The data suggests that those waiting for a “good time” risk negatively impacting their access to capital, ability to attract world-class talent, and overall brand equity.

3. What are U.S. public companies required to report right now?

In the U.S., companies today are required to report on most “G” issues, while reporting on many of the “E” and “S” issues is voluntary. However, this may be changing with several key developments in 2022 for us to consider.

2022 Developments:

- SEC proposal for companies to include climate-related disclosures in their 10-K annual reports.

- SEC proposal for investment advisers and investment companies to enhance disclosures on ESG investment practices.

- Working group petitions SEC for increased focus on Human Capital disclosure requirements in public company filings.

Additionally, the issuance of sustainability reports is becoming more mainstream. In 2020, more than 70 percent of Russell 1000 companies and approximately 90 percent of S&P500 companies published sustainability reports, defined as reports on “corporate sustainability, corporate responsibility, corporate citizenship, ESG, environmental update, and the like,” according to the Governance & Accountability Institute, Inc.

Again, the need for ESG program establishment is only growing in importance. While formal regulatory requirements may take longer to set in, public companies by and large are already issuing these sustainability reports and other disclosure statements, such as proxy filings, to get a head start and reap the potential benefits of being early movers.

4. What are the main ESG reporting frameworks?

One of the most challenging parts of understanding ESG today is developing fluency with the various, and sometimes competing, ESG reporting frameworks. As ESG investing matures, we expect that some of these frameworks will outlast others; however, at the current stage, it’s important to have a working knowledge of the following organizations when discussing ESG.

Key ESG Reporting Frameworks:

- Global Reporting Initiative (GRI)

- International Sustainability Standards Board (ISSB)

- Sustainability Accounting Standards Board (SASB)

- Taskforce on Climate-related Financial Disclosures (TCFD)

- UN Sustainable Development Goals

As organizations progress along their ESG journey, they will find it increasingly important to understand the nuances and incentive differences between reporting frameworks. Generally speaking, we advise clients to begin their ESG journey using a combination of SASB (which considers industry-specific disclosures across E, S, & G) and TCFD (which provides a broadly adopted, industry-agnostic framework for climate-related disclosures.)

As your ESG program evolves, it may make sense to build in alignment with GRI, ISSB, and/or the UN Sustainable Development Goals. The choice of which to follow will depend on your business model and program objectives.

5. What are the main ESG rating agencies?

Today, there are several major rating agencies that provide ESG ratings for publicly listed companies. However, similar to the last section, we will focus your attention on the largest and most influential right now in 2023.

Key ESG Rating Agencies

For those interested in why screening and rating methodologies vary so widely between providers, we highly suggest Tracy Mayor’s article titled Why ESG ratings vary so widely (and what you can do about it) from MIT Sloan. We also recommend keeping your eye on ESG ratings aggregators like CSRHub.

Staying Informed

The world of ESG moves fast and there are plenty of useful, informative newsletters that help us all stay up-to-date on the latest trends and developments (including Sharon Merrill’s own weekly IR Trending, ESG Today, and Fortune’s Impact Report newsletter.) In addition, NIRI, IR Magazine, and Corporate Secretary maintain excellent libraries of ESG articles, webinars, and other resources for continuous learning.

Where to Next?

Over the past decade, we have seen corporate ESG programs evolve from “nice to have” status, to “must have” status. In our coming ESG counsel articles, we will dig deeper into specific topic areas to help you better implement an ESG program that is in line with your needs, whether your program is at its initial stage, farther down the line, or somewhere in between.

At Sharon Merrill, we help companies advance their ESG journeys to enhance long-term value, reduce risk, and drive societal progress. For a full overview of our ESG counsel offerings, please click here. Use the form below to set up an appointment and find out more about how we can help your company build further momentum in ESG.